Tag: debt control

How Budgeting and Debt Control Can Strengthen Your Credit

Your credit score tells lenders how responsible you are with money. It reflects how well you manage payments, debts, and credit limits. Many people focus only on paying bills on time, but good credit is built from consistent financial habits. Budgeting and debt control work hand in hand to create stability. When you have a clear plan for where your money goes, you reduce the risk of missed payments and overspending. That stability is exactly what credit agencies reward.

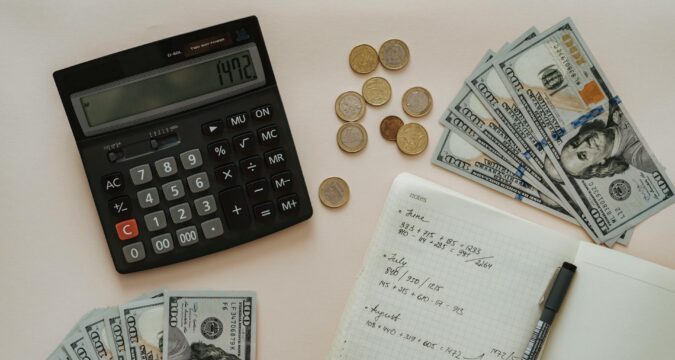

Building a Strong Foundation Through Budgeting

A solid budget is more than a spreadsheet. It’s a financial map. It helps you see where your income goes and how to balance your needs and wants. When you set limits for spending, you’re not restricting yourself; you’re gaining control. You become more intentional with every purchase, saving room for loan payments, credit card bills, and savings goals. Over time, this discipline helps you stay current on obligations, one of the strongest indicators of financial reliability.

Tracking Expenses to Avoid Surprises

Unexpected expenses often lead to debt problems. Budgeting allows you to anticipate and plan for them. Keeping track of every expense, big or small, helps you recognize patterns that may harm your finances. You might realize you’re spending more than you thought on subscriptions or dining out. Once you identify these leaks, you can redirect funds toward paying down debt or building an emergency fund. This proactive approach reduces financial pressure and helps ensure your credit history remains consistent and positive.

Managing Debt to Improve Credit Health

Debt management is at the core of credit strength. The way you handle loans and credit cards impacts your score more than almost anything else. Keeping your balances low and paying on time demonstrates responsibility. Lenders look for borrowers who can manage credit without relying too heavily on it. Paying down high-interest debts first can make progress faster. Each payment you make on time is a step toward proving financial dependability.

Using Credit Wisely and Sparingly

Credit is a tool, not a lifeline. Using it wisely means borrowing only what you can repay. Your credit utilization ratio, the percentage of available credit you use, plays a major role in your score. A lower ratio suggests you’re not overextended. Even if you have multiple cards, keeping balances low sends a message of control. This careful approach helps you maintain healthy credit without feeling burdened. It’s a unique balance between access and discipline that defines long-term financial success.

Setting Financial Goals to Stay Motivated

Budgeting and debt control can feel repetitive, but setting clear goals keeps you focused. Whether you want to buy a car, own a home, or qualify for better loan terms, strong credit makes it easier. Each time you stick to your budget or make an extra payment, you move closer to that goal. Tracking progress keeps you motivated and ensures you don’t lose sight of why you started. Over time, your consistency becomes the foundation of a reliable credit profile.